Estimate employer payroll taxes

You can even set payroll to run automatically. Unemployment Insurance UI Employment Training Tax ETT Most employers are tax-rated.

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

. Just a few clicks and payroll is done. The Tax Withholding Estimator compares that estimate to your current tax withholding and can. Ad Process Payroll Faster Easier With ADP Payroll.

You can use the Tax Withholding Estimator to estimate your 2020 income tax. Both employers and employees are responsible for payroll taxes. Social Security is a 124 payroll tax.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes. Check your tax withholding with the IRS Tax Withholding Estimator a tool that helps ensure you have the right amount of tax withheld from your paycheck.

Half of these payroll taxes. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. See How Easy it is To Run Small Business Payroll and More with Roll by ADP.

Then enter the employees gross salary amount. You can even set payroll to run automatically. Input any additional pay like bonuses or commissions.

You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from. Time and attendance software with project tracking to help you be more efficient. Ad We simplify complex tasks to give you time back and help you feel like an expert.

Our Team of Experts Determine Exactly How Much of a Payroll Tax Refund Youre Entitled To. Social Security accounts for 124. This means they are taxed at 124 62 62.

Dont Leave Money on The Table. Calculating Payroll Taxes. Payroll tax actually includes two different taxesSocial Security and Medicare folded into one known as the Federal Insurance Contributions Act FICA.

Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare. The next step is calculating how much you will need to pay in payroll taxes. Free Unbiased Reviews Top Picks.

An employee will pay 62 Social Security tax on the first 132900 in wages and 145 Medicare tax on the first 200000 in wages 250000 for joint returns. For estimated tax purposes the year is divided into four payment periods. Self-employed individuals must pay the tax equivalent to both the employer and employee portions of the FICA tax.

California has four state payroll taxes which we manage. The SECA tax is. Use this tool to.

Ad Get a Payroll Tax Refund Equal to 26k per Employee. Keep in mind that some pre-tax deductions eg Section 125 plans can lower the gross taxable wages and impact how much. Federal State and Local Taxes All Included.

Then use the employees Form W-4 to fill in their state and federal tax. Get Started With ADP Payroll. Subtract 12900 for Married otherwise.

In addition to hours and pay rates you need to calculate and file FICA state and local taxes if applicable for you and your employees. Ad Compare This Years Top 5 Free Payroll Software. The employer portion is 62 for Social Security and 145 for Medicare and youll collect and remit the same amount from your employees.

2020 Federal income tax withholding calculation. The standard FUTA tax rate is 6 so your max contribution per employee could be 420. Simplify Your Day-to-Day With The Best Payroll Services.

Ad Roll by ADP Runs Payroll in All 50 States. The calculator includes options for estimating Federal Social Security. Ad Focus on Running your Business with the Right Payroll Solutions.

Ad Compare and Find the Best Paycheck Software in the Industry. Just a few clicks and payroll is done. Additionally if your employees work and live in.

For 2020 the Social Security tax will be paid on the first 137700 of wages a 4800 increase from last year. Ad We simplify complex tasks to give you time back and help you feel like an expert. However you can also claim a tax credit of up to 54 a max of 378.

The employer cost of payroll tax is 124. Get It Right The First time With Sonary Intelligent Software Recommendations. Ad No more forgotten entries inaccurate payroll or broken hearts.

This is generally done by completing the following steps.

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Federal Income Tax Fit Payroll Tax Calculation Youtube

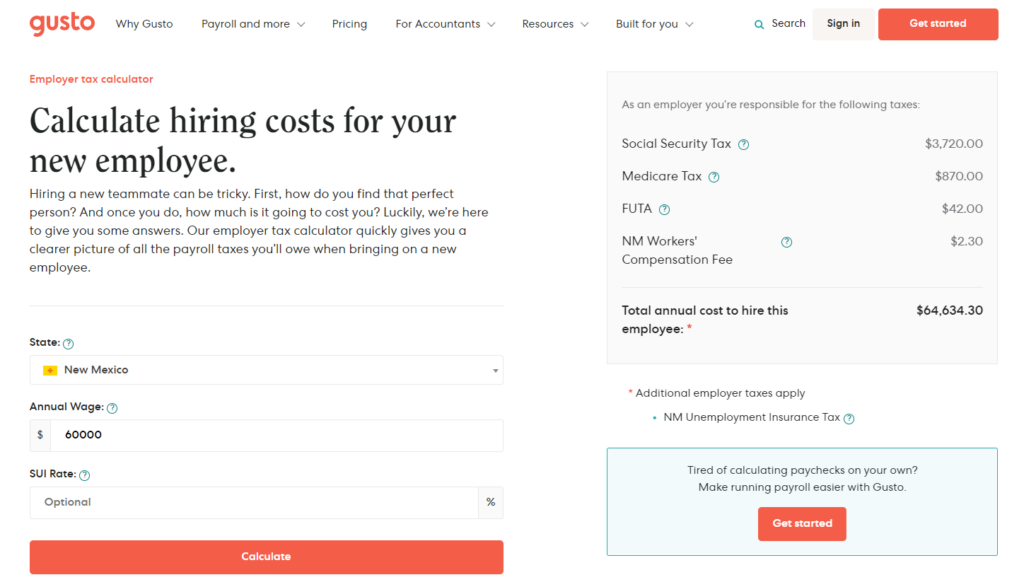

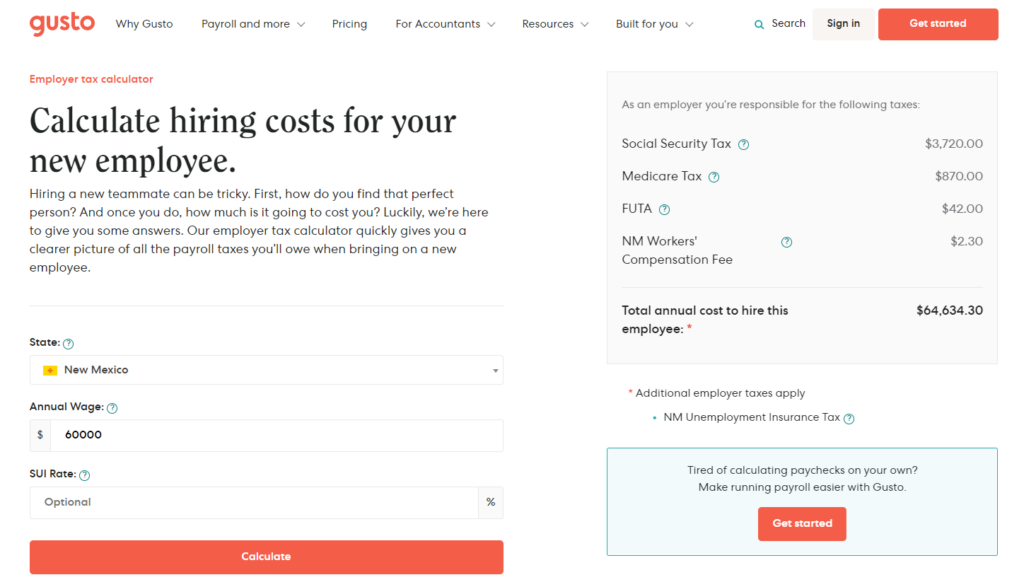

Payroll Tax Calculator For Employers Gusto

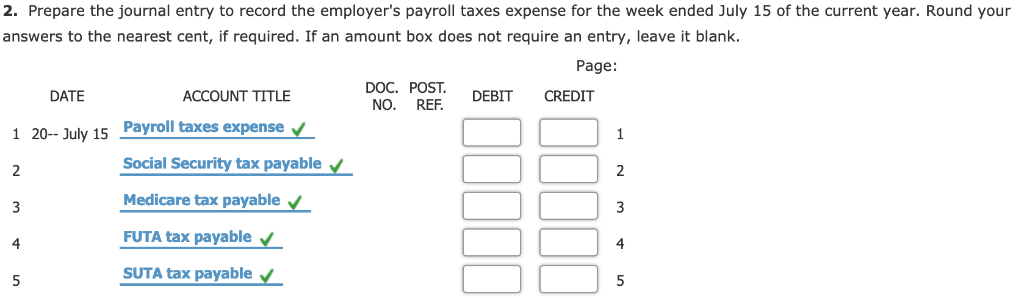

Solved 1 Calculate The Employer S Payroll Taxes Expense Chegg Com

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

Paycheck Calculator Take Home Pay Calculator

How To Do Payroll In Excel In 7 Steps Free Template

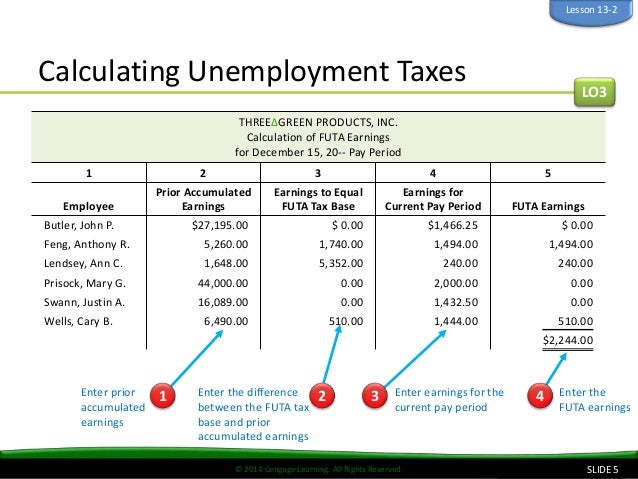

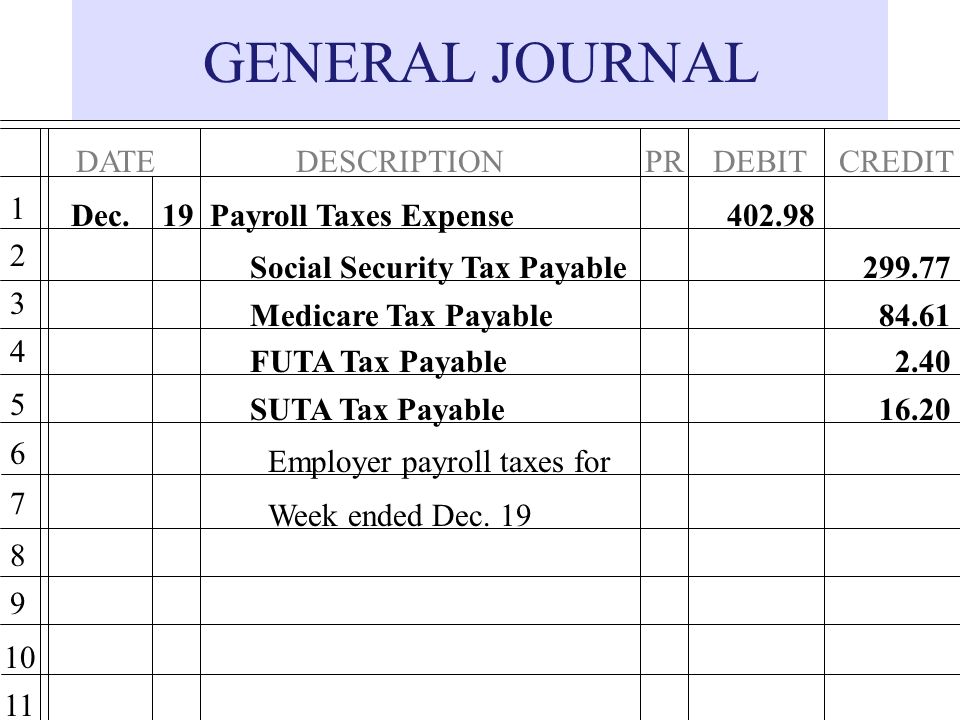

Payroll Accounting Employer Taxes And Reports Ppt Download

Payroll Journal Entries For Wages Accountingcoach

How To Calculate Payroll Taxes In 5 Steps

Payroll Paycheck Calculator Wave

How To Calculate Payroll Taxes Methods Examples More

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How To Calculate Payroll Taxes In 5 Steps

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Taxes How Much Do Employers Take Out Adp