36+ adjustable-rate mortgage definition

A mortgage having an interest rate which is usually initially lower than that of a mortgage with a fixed rate but is adjusted. The initial interest rate is usually lower than that.

Adjustable Rate Mortgage How They Work Pros And Cons

The interest rates are fixed for an initial period but after that they are adjusted.

. For example a 3-year ARM must have an initial fixed period of 36. Afterward the 51 ARM switches to an adjustable. Web Adjustable-Rate Mortgage Definition.

Take Advantage And Lock In A Great Rate. Use NerdWallet Reviews To Research Lenders. This type of mortgage typically begins with an interest rate that is fixed for a period.

Bank Home Loan Officer To Support You Throughout The ARM Loan Process. An adjustable-rate mortgage is a home loan with an interest rate that changes over time based on market conditions. Web adjustable rate mortgage noun.

These loans may also be called variable. Is an ARM loan the same as a variable-rate mortgage. Web 102635 Requirements for higher-priced mortgage loans.

Veterans Use This Powerful VA Loan Benefit for Your Next Home. Web Adjustable-rate mortgages have interest rates that are adjusted throughout the term. Ad Calculate Your Payment with 0 Down.

Ad Connect With A Loan Officer Today. Web An adjustable-rate mortgage is a home loan with an interest rate that changes over time based on market conditions. Web A 51 ARM is a type of adjustable rate mortgage loan ARM with a fixed interest rate for the first 5 years.

Web There can be some mystery surrounding an adjustable-rate mortgage or ARM. Web At Griffin Funding rate adjustments are capped at 5 above your initial rate and 1 2 or 5 per adjustment period in most cases. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Web An adjustable-rate mortgage ARM is a loan where the interest rate is fixed for a specific amount of time then adjusts periodically. Web The initial adjustment period in months must align with the initial fixed-rate period in years. Web With an adjustable-rate mortgage ARM the interest rate changes periodically and your payments may go up or down.

Web A That compensation is paid by a consumer to a mortgage broker as defined in 102636 a 2 and already has been included in points and fees under paragraph b 1 i of. Take this adjustable-rate mortgage example. Start Our ARM Online Application.

Web The Consumer Financial Protection Bureau released a fact sheet on the interest rate used to calculate prepaid interest for qualified mortgages under the price. 102636 Prohibited acts or practices and certain requirements for credit secured by a dwelling.

Document

Adjustable Rate Mortgage Smartasset Com

Chart Fixed Rate Versus Adjustable Rate Mortgages

Adjustable Rate Mortgage 101 How They Work And Why They Can Be A Cheaper Option

What Is An Adjustable Rate Mortgage Rocket Mortgage

Adjustable Rate Mortgage 101 How They Work And Why They Can Be A Cheaper Option

7 Best Heloc Lenders For February 2023 Lowest Fees Fastest Finder

Adjustable Rate Mortgage Arm

What Is Adjustable Rate Mortgage Definition By All Finance Terms

7 Best Heloc Lenders For February 2023 Lowest Fees Fastest Finder

How To Get A Mortgage Home Loan Tips

What Is An Adjustable Rate Mortgage Nerdwallet

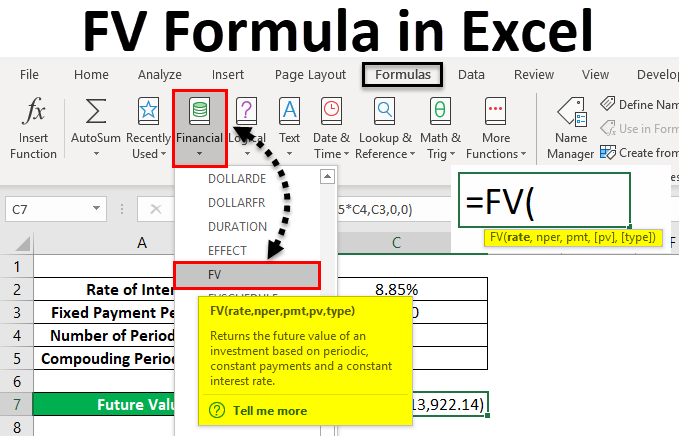

Fv Formula In Excel Examples How To Use Excel Fv Formula

Adjustable Rate Vs Fixed Rate Mortgage Calculator

Best Current Adjustable Mortgage Rates The Complete Hybrid Arm Loan Guide For Home Buyers

The Average Adjustable Rate Mortgage Is Nearly 700 000 Here S What That Tells Us Marketwatch

:max_bytes(150000):strip_icc()/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg)

Fixed Rate Vs Adjustable Rate Mortgages